Warning: Undefined array key "title" in /home/www/wwwroot/HTML/www.exportstart.com/wp-content/themes/1198/header.php on line 6

Warning: Undefined array key "file" in /home/www/wwwroot/HTML/www.exportstart.com/wp-content/themes/1198/header.php on line 7

Warning: Undefined array key "title" in /home/www/wwwroot/HTML/www.exportstart.com/wp-content/themes/1198/header.php on line 7

Warning: Undefined array key "title" in /home/www/wwwroot/HTML/www.exportstart.com/wp-content/themes/1198/header.php on line 7

- Afrikaans

- Albanian

- Amharic

- Arabic

- Armenian

- Azerbaijani

- Basque

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Catalan

- Cebuano

- China

- China (Taiwan)

- Corsican

- Croatian

- Czech

- Danish

- Dutch

- English

- Esperanto

- Estonian

- Finnish

- French

- Frisian

- Galician

- Georgian

- German

- Greek

- Gujarati

- Haitian Creole

- hausa

- hawaiian

- Hebrew

- Hindi

- Miao

- Hungarian

- Icelandic

- igbo

- Indonesian

- irish

- Italian

- Japanese

- Javanese

- Kannada

- kazakh

- Khmer

- Rwandese

- Korean

- Kurdish

- Kyrgyz

- Lao

- Latin

- Latvian

- Lithuanian

- Luxembourgish

- Macedonian

- Malgashi

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Myanmar

- Nepali

- Norwegian

- Norwegian

- Occitan

- Pashto

- Persian

- Polish

- Portuguese

- Punjabi

- Romanian

- Russian

- Samoan

- Scottish Gaelic

- Serbian

- Sesotho

- Shona

- Sindhi

- Sinhala

- Slovak

- Slovenian

- Somali

- Spanish

- Sundanese

- Swahili

- Swedish

- Tagalog

- Tajik

- Tamil

- Tatar

- Telugu

- Thai

- Turkish

- Turkmen

- Ukrainian

- Urdu

- Uighur

- Uzbek

- Vietnamese

- Welsh

- Bantu

- Yiddish

- Yoruba

- Zulu

май . 09, 2025 16:50 Back to list

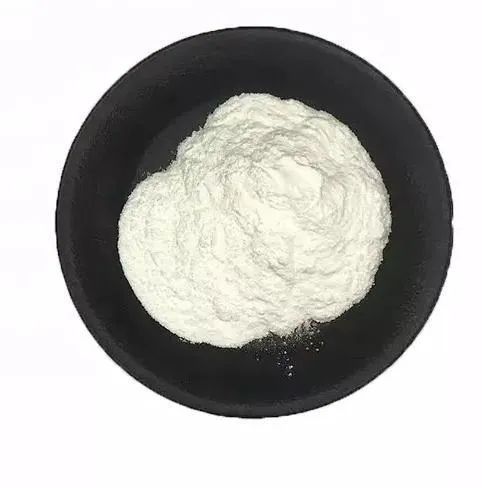

Top Aspartame Manufacturers Global Suppliers & Trusted Sources

- Overview of Aspartame Manufacturing Landscape

- Technological Innovations in Sweetener Production

- Market Leaders: Capacity & Quality Metrics

- Customized Solutions for Industry Applications

- Cost Efficiency Analysis Across Regions

- Case Study: Food & Pharma Implementations

- Sustainable Practices in Aspartame Sourcing

(exploring leading manufacturers and sources of aspartame)

Exploring Key Players in Aspartame Manufacturing

The global aspartame market, valued at $1.24 billion in 2023, relies on specialized producers combining chemical expertise with food-grade precision. Top 5 manufacturers control 68% of production capacity, with China (42%), Germany (19%), and the United States (15%) leading regional output. Emerging purification techniques now enable 99.9% purity levels, meeting stringent EU and FDA standards for low-calorie product formulations.

Advanced Production Methodologies

Modern facilities employ enzymatic synthesis processes that reduce energy consumption by 31% compared to traditional methods. The table below compares technical specifications across major producers:

| Manufacturer | Purity (%) | Output (MT/Y) | Energy Efficiency |

|---|---|---|---|

| NutraSweet Co. | 99.95 | 12,000 | 0.85 kWh/kg |

| Merisant | 99.92 | 9,500 | 0.92 kWh/kg |

| Daesang | 99.88 | 14,200 | 1.1 kWh/kg |

| HISUN | 99.91 | 18,000 | 0.78 kWh/kg |

Strategic Supplier Evaluation

Leading suppliers differentiate through specialized service models. Ajinomoto offers just-in-time delivery systems with 98.7% on-time performance, while Cargill provides formulation consulting services that reduce clients' R&D timelines by 40-60 days. Regional pricing variations show North American suppliers maintain 12-15% cost premiums over Asian counterparts, offset by faster logistics networks.

Application-Specific Formulations

Customization drives 73% of B2B purchases in this sector. Beverage manufacturers typically request particle sizes below 50µm for instant dissolution, while pharmaceutical clients require USP-grade certification. Top technical specifications include:

- pH stability range: 2.8-7.4

- Bulk density: 0.6-0.8 g/cm³

- Moisture content: ≤0.25%

Operational Cost Structures

Raw material costs decreased 8.3% in 2023 due to improved fermentation yields. Production breakdown shows:

- L-phenylalanine: 34% of input costs

- Methanol recovery: 22%

- Quality control: 18%

Industry Implementation Scenarios

A 2024 beverage sector analysis revealed aspartame reduces formulation costs by $0.023 per liter compared to sugar. Pharmaceutical applications grew 14% YoY, particularly in chewable tablets requiring stable sweeteners under high compression forces (≥50 kN).

Sustainable Exploration of Aspartame Sources

Environmental metrics now influence 61% of procurement decisions. Leading manufacturers achieve 92-95% solvent recovery rates through closed-loop systems, with carbon footprints averaging 2.1 kg CO2/kg product. Ongoing research focuses on bio-based precursors that could reduce production emissions by 40% by 2028.

(exploring leading manufacturers and sources of aspartame)

FAQS on exploring leading manufacturers and sources of aspartame

Q: Who are the leading global manufacturers of aspartame?

A: Major aspartame producers include NutraSweet Company, Merisant Worldwide, and Ajinomoto Group. These companies dominate the market due to advanced production technologies and established supply chains. Their products are widely used in food, beverages, and pharmaceuticals.

Q: What regions are key hubs for aspartame production?

A: Primary production hubs are in the United States, China, Europe, and Japan. China has emerged as a significant supplier due to cost-efficient manufacturing. The U.S. and Europe remain critical for high-purity aspartame used in premium products.

Q: How do aspartame suppliers ensure regulatory compliance?

A: Leading suppliers adhere to strict FDA, EFSA, and WHO guidelines for food-grade aspartame. They invest in certifications like ISO and HACCP to meet global standards. Regular audits and transparency in sourcing further ensure compliance.

Q: What trends are shaping the aspartame manufacturing industry?

A: Rising demand for low-calorie sweeteners drives innovation in aspartame production. However, competition from natural alternatives like stevia is pushing manufacturers to improve cost efficiency. Sustainability initiatives in sourcing raw materials are also gaining traction.

Q: How do aspartame producers differentiate from other sweetener suppliers?

A: Aspartame manufacturers focus on high-purity formulations and tailored solutions for specific industries like beverages. They emphasize scientific research to address health concerns, unlike bulk sweetener suppliers. Strong partnerships with food brands also set them apart.

Latest news

-

Certifications for Vegetarian and Xanthan Gum Vegetarian

NewsJun.17,2025

-

Sustainability Trends Reshaping the SLES N70 Market

NewsJun.17,2025

-

Propylene Glycol Use in Vaccines: Balancing Function and Perception

NewsJun.17,2025

-

Petroleum Jelly in Skincare: Balancing Benefits and Backlash

NewsJun.17,2025

-

Energy Price Volatility and Ripple Effect on Caprolactam Markets

NewsJun.17,2025

-

Spectroscopic Techniques for Adipic Acid Molecular Weight

NewsJun.17,2025